One of the greatest advantages of home ownership at The Cloister is the Universal Design features built into every Cloister home. Universal design creates an attractive, stylish space that everyone, regardless of age, size, or ability, can live in or visit. A home with Universal Design makes it easier for us to live in, and for guests to visit now and in the future, even as everybody’s needs and abilities change.

One of the greatest advantages of home ownership at The Cloister is the Universal Design features built into every Cloister home. Universal design creates an attractive, stylish space that everyone, regardless of age, size, or ability, can live in or visit. A home with Universal Design makes it easier for us to live in, and for guests to visit now and in the future, even as everybody’s needs and abilities change.

Home Features and Products Using Universal Design

Downsizing to a universal design home is usually much cheaper than remodeling a house with traditional design features although I have seen a ranch style home on Brook Hollow Road in West Meade where the entire front yard was landscaped to change a four step entry porch to a stepless entry front entrance.

Having Universal Design features and products in a home makes good sense and can be so attractive that no one notices them — except for how easy they are to use.

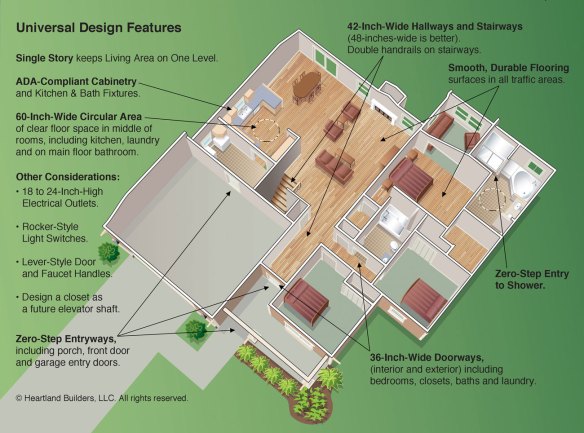

Essential Universal Design features include:

- No-step entry: At least one step-free entrance into your home — either through the front, back, or garage door—lets everyone, even those who use a wheelchair, enter the home easily and safely.

- Single-floor living: Having a bedroom, kitchen, full bathroom with plenty of maneuvering room, and an entertainment area on the same floor makes life convenient for all families.

- Wide doorways and hallways: With your home’s doorways at least 36 inches wide, you can easily move large pieces of furniture or appliances through your home. Similarly, hallways that are 42 inches wide and free of hazards or steps let everyone and everything move in, out, and around easily.

- Reachable controls and switches: Anyone — even a person in a wheelchair — can reach light switches that are from 42-48 inches above the floor, thermostats no higher than 48 inches off the floor, and electrical outlets 18-24 inches off the floor.

- Easy-to-use handles and switches: Lever-style door handles and faucets, and rocker light switches, make opening doors, turning on water, and lighting a room easier for people of every age and ability.

There are many other universal design features and products that many people put into their homes, including:

- Raised front-loading clothes washers, dryers, and dishwashers

- Side-by-side refrigerators

- Easy-access kitchen storage (adjustable-height cupboards and lazy Susans)

- Low or no-threshold stall showers with built-in benches or seats

- Non-slip floors, bathtubs, and showers

- Raised, comfort-level toilets

- Multi-level kitchen countertops with open space underneath, so the cook can work while seated

- Windows that require minimal effort to open and close

- A covered entryway to protect you and your visitors from rain and snow

- Task lighting directed to specific surfaces or areas

- Easy-to-grasp D-shaped cabinet pulls

https://cloisterliving.wordpress.com/2012/06/23/making-cloister-life-a-little-easier/